During the hottest day of the year so far, in Washington, DC, a team of over 400 wind, solar, and battery storage professionals and staff of American Clean Power (cleanpower.org, ACP) gathered on the Hill to discuss and then meet with congressmen, senators, and staff to discuss the importance of alternative energy and electrical reliability.

This annual event was felt to be a little more important this year, given the negative attention alternative energy has received since both parties decided to make parts of the energy ecosystem political vs vital.

Why This Year’s Hill Visit Mattered More Than Ever

On the block was the need to make sure that all energy sources had the means to streamline permits from concept to completion to eliminate uncertainty (message to Democrats) and that the promised 10-year ‘clean energy’ tax credits were critical for continued investment due to existing investments in planned and approved sites (message to Republicans).

I suppose I’d be remiss if I did not mention that ALL energy types in the USA are subsidized through tax credits; alternative energy is the only set that has to be periodically approved.

All energy types in the USA are subsidized—only clean energy must be periodically approved.

Disclaimers, etc.: No, I will not go into political positioning/opinion in this article, but yes, I will be discussing politics – it is an article about a visit to politicians, after all, and the potential impact on our direct business and personal energy costs. We will discuss a few engineering facts and positions from the electrical energy industry – I am the CIGRE-USNC A1 regular member, and this is a genuine concern.

The positions given in this article will relate to utility industry facts and projections as published by CIGRE (International Council on Large Electric Systems), US DOE (Department of Energy), US EIA (Energy Information Administration), and other authorities, as well as ACP.

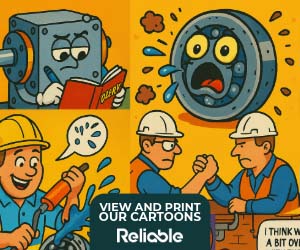

Figure 1: Changes to US Installed Generating Capacity by Source

Based on the expected increase in data centers, primarily driven by AI, which is expected to consume over 25% of all electricity generated in the USA by 2040, the expected electrical demand is expected to grow up to 50% by 2040 (re: S&P Global Commodity Insights study).

AI data centers could consume 25% of all U.S. electricity by 2040.

Other studies, including those by CIGRE, show less aggressive growth but still well outside of present capacity and expected addition to supply and, more importantly, transmission and distribution (i.e., the Grid!).

The CIGRE study identified a global increase from 4,200 terawatt-hours (TWh) in 2018 to approximately 5,500 TWh by 2050, which would be an average annual global growth rate of less than 1%. However, a majority of growth is expected in developed countries such as the USA.

The Demand Surge: AI, Data Centers, and Grid Strain

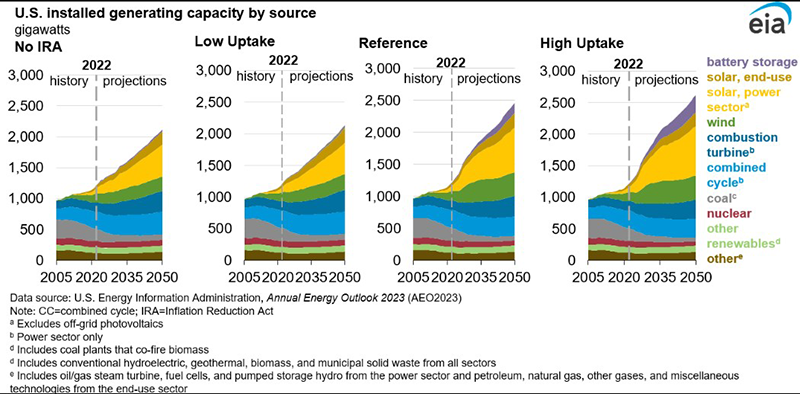

The changes in demand are already impacting availability, with the capacity prices for the MISO (Midcontinent Independent System Operator) jumping from $30/MW-day (Megawatt-day) in summer 2024 to $666.50/MW-day for summer 2025.

The full annual cost cleared $217/MW-day for the year. This directly represents the constraints due to a decrease in surplus capacity, with the summer surplus dropping from 4.6 Gigawatt (GW) to 2.6 GW leading into 2025.

Figure 2: Grid Operator Areas

This basically means that power capacity is not keeping up with demand with a combination of 3.3 GW of power plant retirements, 900 MW (Megawatt) in reduced imports from surrounding operators, and 4.9 GW in reduced accreditation combined with an increase of 5.1 GW new capacity (largely alternative, or clean, energy) and 1.2 GW in increased accreditation.

Accredited means a power generation resource’s total capacity that is officially recognized as reliably available to meet peak demand requirements, especially during critical demand periods. It plays a significant role in capacity planning and grid reliability.

Dispatchable resources like natural gas, coal, or nuclear are accredited close to nameplate capacity, and intermittent resources like solar or wind receive a lower accreditation due to variability – which is adjusted with associated storage such as battery or pump storage.

This calls for a serious need to increase capacity and transmission, including between operators immediately. With present regulations, it can take an average of 7-10 years to process the permitting, legal challenges, and finally build out alternative energy resources and about the same time, or more, for dispatchable resources (permitting is similar) but longer for building plants and receiving materials.

The good news is that adequate resources will exist at least through May 2026. There will be a variable impact on customer pricing during this period, depending on capacity shortfall and terms of wholesale power purchase agreements and state-regulated retail rates.

Howard Penrose in front of the Capital

When looking at S. Illinois (MISO) and N. Illinois (PJM), for instance, there would be a projected status quo for S. Illinois and an increase of 45.5% for N. Illinois and Chicago (starting June 1, 2025).

Any stall may directly impact this in increasing capacity and transmission coupled with increases in demand, including additional data centers driven by demand for ‘AI’ data centers, which have two distinct planning challenges: 1) increases in demand upwards of 25% for extended periods during training/retraining, and, 2) sudden drops from grid supply due to trips, maintenance or other causes, often without communicating with the utility.

The scope of the newer AI-style data centers is the size ranging from the smaller 200 MW sites to an average request of 500 MW data centers and discussions related to sites ranging from 500 MW to 1.5 GW. Based on Federal and State policies and other factors, most consumers in the area will share the costs associated with building out transmission, distribution, and generation to support these facilities.

This part can become more complex. At the same time, we have seen organizations such as Microsoft reduce planned AI data center planning by ~2.2 GW in the USA, which others may follow, depending on the perceived plan for AI integration. At the same time, the primary cost for operating these facilities is electrical power, which may also impact costs associated with using this technology.

Inside the Meetings: What Congress Heard From Clean Energy Leaders

Armed with this information, we approached representatives on the Hill by dividing them into groups by state. We had visits with Congressman Casten (D-IL06), who was present, Congresswoman Delia Ramirez (D-IL03), Senator Dick Durbin (IL), Congressman Danny Davis (D-IL07), Congresswoman Mary Miller (R-IL15), and Congressman Darin LaHood (R-IL16) for the Illinois delegation.

I’ve been visiting a variety of Hill meetings associated with energy in the mid-1990s (starting in 1993) as the regional energy representative for IEEE during deregulation and US DOE energy programs, then in the late 1990s and 2000s for energy programs, then after founding the SMRP government relations program for workforce, cybersecurity, utilities, safety, and other opportunities, then workforce and back to energy. Yes, it was long-winded, but it put this year’s visit into perspective.

Figure 3: Congressman Casten (7th from the right) and the ACP Illinois team and staff

The primary discussion in Rep. Casten’s office, which I have visited over the past ~6 years, is to discuss clean energy. He had spent over 20 years building natural gas and Cogen plants before entering government and participating on the Congressional Energy Committee. Much of our discussion surrounded streamlining the permitting process while maintaining present legal requirements.

Most of the ACP participants were on the management and planning side of wind, solar, and storage, with a few of us involved in field testing and working to maintain site reliability. There was also discussion of the number and size of data centers that were permitted and moving forward in the district and Chicagoland area with limited power generation and transmission growth.

Overall, the other Democrat meetings were similar, with discussions related to increasing demand, such as data centers (a very hot topic everywhere) and the impending energy crisis. There were definite discussions along ideological lines, which, as a group, we were advised to and generally avoided. It is equally important to note that discussions in person and with staff tend to be reasonable and not at all what you see on TV.

In D.C., energy debates are grounded in facts—despite what you see on TV.

Visits such as this are generally ‘fact-finding’ for both the representatives, staff, and attendees. Note that the members we met generally represented members of the delegations. With only one exception, the representatives (and/or staff) voiced their support for our positions and had open discussions about electrical reliability.

There are, notably, some ideological differences related to the administration on how electrical energy should be dealt with – with some discussion about existing bills that environmental protections should be managed differently and notification for locals to respond being reduced from undetermined length (often 5-6 years) to under 120 days.

Figure 4: Delegation following a meeting in Senator Durbin’s office. Far left – one of his staff on energy policy.

What’s at Stake: Costs, Policy Gridlock, and the Path Forward

The general feeling is that much of the needed energy legislation may be stalled as ideological differences related to the energy mix are argued, which will impact meeting requirements in the next few years. This is no different as the pendulum has swung in the other direction, and the same concerns were realized in traditional energy production.

Notably, most of the grid/utility industry sees an ‘all of the above’ need for energy production and mix for energy security and to meet rapidly growing demand. This includes companies committed to moving manufacturing back to the USA, which will require an increase in demand in all energy sectors.

In the meantime, existing and new industry costs, commercial facilities costs, and the cost of living will increase based on electrical demand and availability. This means that it is more important than ever that a focus on energy efficiency is introduced in order to manage costs.

These improvements are brought about through a combination of proper equipment selection and proper maintenance, which is directly tied to energy improvements. See Electrical Signature Analysis Case Studies: From Detection to Resolution; How Reliability Strategies Cut Compressed Air Energy Costs; Strategic Asset Management: A Key Driver of Energy Efficiency; and other articles within Reliable Magazine related to this topic.