Asset management focuses on realizing value while balancing cost, risk, and performance, which is another way of saying that it is all about decision-making.

In the fast-paced world of industrial operations and production, the ability to make decisions is at the heart of the organization’s ability to maximize performance, reduce downtime, and extend the life span of its assets, all at reasonable cost and acceptable risk. This is a tall order! Processes can be complex and require a blend of technical knowledge, financial awareness, and risk management.

The GFMAM Asset Management Landscape highlights why ‘asset management is the coordinated efforts of the organization to deliver value from assets.’

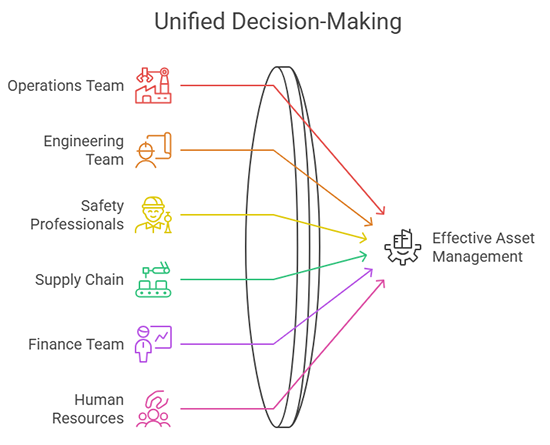

No single individual or team has all the answers—collaboration is key.

No single individual or team will have all the information by themselves; multiple stakeholders contribute to making smarter decisions.

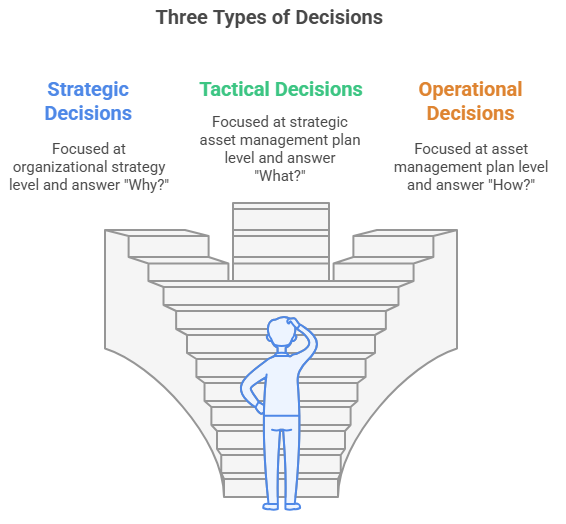

Three Types of Decisions: Strategic, Tactical and Operational

Strategic decisions are focused at the Organizational Strategy level and answer the question: Why?

Tactical decisions are typically focused at the Strategic Asset Management Plan level and answer the question: What?

Operational decisions are focused at the Asset Management Plan level and answer the question: How?

It is critical that information flow between and across teams and up and down the organizational hierarchy to create alignment between front-line decisions and the organization’s overall strategic goals and objectives.

Importance of Data-Driven Decisions

At the heart of effective decision-making is reliable, accurate, and timely data. Without it, decision-makers risk making assumptions that can lead to costly and unintended mistakes.

The era of big data, the Internet of Things (IoT), and the substantially decreased relative costs of sensors and data analytics have drastically changed how maintenance and reliability professionals – engineers, technologists, technicians, and skilled trades – approach their roles.

This dramatic change in predictive maintenance (PdM) technology application, condition monitoring, and real-time data collection has enabled teams to make recommendations and decisions based on facts rather than intuition or ‘gut feel.’

A reliability professional in a manufacturing plant or continuous processing industry may use real-time continuous vibration analysis to assess the health of a motor. Combined with data from the equipment’s historical performance, periodic condition monitoring analysis, maintenance work order records, and operational data, they can predict when the motor starts to fail.

Instead of waiting to react to unforeseen breakdowns, the Reliability Professional can work with the Maintenance Planner, Maintenance Scheduler, and Operations Coordinator to complete the required restoration or replacement work to minimize the impact on production schedules.

The Asset Manager can also use the information as input to the overall equipment lifecycle evaluation to identify any overall end-of-life considerations. In a smaller production facility, these roles may be the same person wearing different hats, but the same decision-making principles apply.

So many of us are drowning in data and starving for information when we should strive for data, leading to information that gives us the knowledge to make informed decisions.

We’re drowning in data but starving for information.

The ability to aggregate and analyze accurate and timely data from multiple sources and interpret it correctly is foundational to good decision-making and delivering value for the organization.

Risk-Based Decision Making

For reliability professionals and asset managers, risk is an ever-present consideration. It is an underlying component to many, if not all, of the operational and regulatory requirements that production facilities must adhere to—food safety, pressure equipment and overpressure protection, and fire code, just to name a few.

Every industry sector will have a unique set of requirements, and it is incumbent on maintenance and reliability professionals and asset managers to be aware of the ones for their own facilities.

Decisions such as when to replace or repair a failing asset or significant piece of equipment or invest in a new one require careful risk assessment, including understanding the overall asset lifecycle for the production facility and the specific production equipment. In many cases, the cost of inaction can be higher than that of a significant asset replacement or repair.

This is particularly true in asset-intensive 24x7x365 production operations and points to where risk-based decision-making becomes vital to meeting overall production commitments.

No single individual or team has all the answers—collaboration is key.

Risk-based decision-making includes evaluating the potential consequences of a failure, weighing those risk consequences against the likelihood of an event occurring, and determining the best course of action to take that minimizes risk while still optimizing performance and associated costs.

Each organization should have a risk matrix that is used to provide more consistency in these evaluations, aligning with the organizational risk tolerance and commitment.

A typical example might be a fleet of industrial pumps or compressors that are starting to show normal and expected signs of wear. The reliability professional can evaluate the speed at which the failure progresses, the cost of a failure (e.g., potential safety or health concerns, possible environmental impacts, production stoppage or restrictions), and the costs of repairs or replacement.

This supports a reliability recommendation that balances the operational risks with financial implications. Risk-based decision-making helps reliability professionals and asset managers make tough recommendations and operational, tactical, and strategic decisions by giving them a structured framework for evaluating cost, risk, and performance to maximize overall value for the organization.

Reliability tools and methodologies for developing maintenance strategies, like Reliability-Centered Maintenance (RCM) or Failure Modes and Effects Criticality Analysis (FMECA), can all support risk-based decision-making by identifying potential failure modes and their potential effects on asset performance.

By taking this one step further, we can use this information to set asset criticality rankings, ensuring that our resources, both people and dollars, are allocated to those assets and equipment where they can deliver the most value to the organization.

Cost Benefit Analysis

A key element in all decision-making is understanding each potential decision’s estimated costs and benefits. This includes the costs and benefits of sticking with the status quo – sometimes called the ‘do nothing’ option.

As outlined in the GFMAM Asset Management Landscape and my previous article on How Reliability Professionals Drive Value Across the Triple Bottom Line, asset management focuses on delivering value with a balance of cost, risk, and performance.

In the world of the reliability professional, these are frequently measured in terms of improved safety and environmental compliance, increased equipment availability – leading to increased uptime, reduced overall maintenance costs, and extended asset life.

A cost-benefit analysis assists in weighing competing priorities and aligning them to the overall organizational strategic objectives and value. A typical example occurs when a complex or critical asset is nearing the end of its lifespan.

A decision may need to be made on whether to continue to repair the aging asset or replace it entirely, possibly with a ‘new and improved’ modern version. In this context, reliability professionals and asset managers would work together to determine the appropriate recommendation using a cost-benefit analysis.

Ignoring asset lifecycle costs today leads to expensive surprises tomorrow.

The reliability professional, along with the asset manager, would consider future costs of ongoing repairs (including parts, labor, and any associated downtime) for both the existing asset as well as any replacement asset, the cost of a new replacement asset, the expected improved performance of the new asset, and any expected long-term savings or additional production capability from the new asset.

The asset manager will also consider the overall strategic direction of the organization and its relationship to the asset in question – do demand planning projections support additional production from the asset? For how many more years? How do capital investment decisions and resource allocation factor in?

The decision is frequently not clear-cut, and many scenarios will be considered. Typically, there are no perfect answers and reliability professionals, and asset managers use data, information, and analysis coupled with their experience and technical judgment to make recommendations and decisions.

Evolving Technology to Support Better Decisions

Every day, the technology for monitoring asset performance through predictive analytics, artificial intelligence, machine learning, and even the speed at which we can run scenarios, increases and becomes more complex.

Reliability professionals can anticipate equipment failures before they happen, optimize maintenance scheduling, and automate asset health monitoring and similar routine tasks. Evolving technology enables reliability professionals to make recommendations and decisions more confidently, efficiently, and effectively than before.

Integrated Approach: Collaboration

Good decision-making isn’t just focused on number crunching and data analysis; the heart of asset management is ‘the coordinated efforts of the organization to deliver value from assets.’ (GFMAM Asset Management Landscape). This reminds us of the need for strong collaboration and communications – Asset Management is a team sport!

Asset managers and reliability professionals work with cross-functional teams, including Operations, Engineering, Occupational and Process Safety, Supply Chain Management, Finance, Human Resources, and so on.

Effective decision-making requires bringing together the perspectives of each of these teams for a coordinated approach. A great analogy is that each team looks through its own lens. Bringing these lenses together is like a telescope – the picture becomes more apparent and closer.

Your best reliability tool? A well-informed team.

Communication goes hand in hand with collaboration and is imperative for ensuring that decisions are correctly executed. Decisions can be made in emergencies, urgent scenarios, or for long-term benefits tied to strategic goals.

Asset managers must effectively convey decision outcomes and maintain a consistent message. This communication needs to reach various stakeholders, including the C-suite, front-line workers, suppliers, customers, and community groups.

Driving Smarter Decisions for Long-Term Success

Asset Management focuses on the realization of value while balancing cost, risk, and performance, which is another way of saying it is all about decision-making. Making decisions is all about having the right information to be able to make the decision. So many of us are drowning in data and starving for information.

We should strive for data leading to information that gives us the knowledge to make informed decisions. After implementing the decisions, we can continue using our plan-do-check-act continuous improvement loop to balance cost, risk, and performance. It’s not one-and-done; organizations face relentless internal and external change that demands a response based on a structured approach to decision-making.

Reliability professionals – engineers, technologists, technicians, and skilled trades – have a critical role to play in making decisions that impact an organization’s ability to meet its strategic objectives.