The market is flooded with wireless condition monitoring products, and vendors are ringing your phone off the hook to entice you into a trial run. Your boss has tasked you with picking a vendor to partner with, and now you’re like a deer in the headlights.

What now?

When I first engaged the Condition Monitoring eco-system in 2008, it was with a mandate to define and develop a MEMS accelerometer roadmap capable of high-fidelity vibration measurement. At that time, only a couple of companies were venturing to make a wireless vibration sensor, and only one of the three had adopted MEMS technology.

Today, nearly 100 vendors of such products are in my database, offering more than 130 wireless sensor models, the overwhelming majority of which are equipped with an embedded MEMS triaxial sensor. This represents a 22% annual growth rate.

Figure 1. The number of wireless condition monitoring sensor models and vendors has experienced rapid growth over the last 15 years, with wide variation in performance, power, and cost positioning. Source: The Machine Instrumentation Group.

In excess of $400M has been put to work by early-stage capital and private equity investors, with untold amounts of money invested by self-funded market leaders.

It is a fair question to ask whether this is another example of ‘irrational exuberance’ on the part of the investment community. Still, the response from many maintenance and reliability observers suggests instead that they are part of a largely unserved market.

Professional investors looking for potential winners among new technology companies like these do it for a living. However, from the vantage point of a maintenance manager or reliability engineer, selecting a partner to invest in is daunting.

Maintenance and reliability teams believe in the potential of wireless condition monitoring—but the challenge is navigating the overwhelming number of options and vendor claims.

Maintenance and Reliability clients already believe that this technology can improve the effectiveness of a predictive maintenance (PdM) program. Still, it’s not always clear how the new capabilities achieve the objectives with a justifiable ROI. The technology is unfamiliar, the vendor pitches are confusing, and the sheer number of options is overwhelming.

Understand the Technology and Performance Trade-offs

Enabled by technologies such as MEMS accelerometers, low-cost and efficient wireless protocols, multiple sources of semiconductor radios, and advanced data processing for diagnostics, wireless condition monitoring vendors with various backgrounds have emerged worldwide.

IoT and software companies, PdM service providers, industrial equipment manufacturers, sensor manufacturers, instrumentation companies, and defense-related firms have all gotten into the act.

With all the new technology applied, uncertainties abound. For example, what level of measurement fidelity can I expect from the embedded MEMS accelerometer compared to legacy technology?

Accelerometer component vendors provide nearly 40 products for the IoT designer to choose from, representing both chip scale MEMS and embeddable piezoelectric components, with a broad spectrum of price, performance, power, and integrated features such as digital filtering.

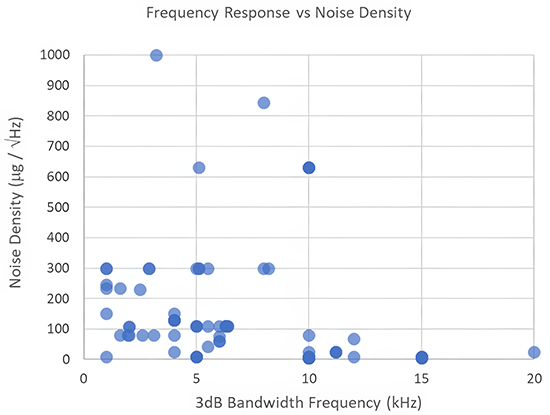

Figure 2. This plot shows the performance positioning of commercially available wireless vibration sensors. Noise and frequency specifications are considered important factors for early bearing fault detection. A 3dB frequency response of 11kHz has been achieved with a state-of-the-art MEMS device, but a higher frequency response than this uses a piezoelectric pellet. Most MEMS-equipped sensors specify much lower frequencies. Source: The Machine Instrumentation Group.

Determine your Key Selection Criteria

Downselecting by sensor performance and features can trip up an experienced vibration analyst when examining specifications written by IoT engineers. Should we really care that the wireless sensor using the BLE 5.0 protocol can transmit a signal with up to +8dBm of power? How does the integrated digital filtering in the MEMS device affect measurement fidelity?

Even experienced analysts can struggle to interpret wireless sensor specs written by IoT engineers—context matters.

What exactly is ‘noise density,’ and how much is too much for timely detection of an emerging bearing fault? Battery life specs are cited with the caveat ‘dependent on conditions’ – precisely what does that mean, and how confident can I be that the sensor will really operate for 5 years in my plant?

The maintenance analyst might be on more solid ground regarding signal processing and statistics, but how exactly to interpret the claim that the system diagnostics is ‘automated’ and can be trained over time – can we trust the algorithms, or are real human analysts still involved?

Automated diagnostics can help scale the service of vendors offering remote vibration analysis and reporting from a lab staffed with competent human analysts, lowering costs. At the same time, we gain confidence in the diagnostic accuracy.

Although I agree that “AI” in this application has been over-hyped, there is a place for data-driven approaches to anomaly detection and diagnostics, with the most productive experience being working with equipment OEMs to expand fault coverage.

Evaluate Vendors for Long-Term Success

Finally, no one wants to repeat this exercise a year or two down the road, so you must ensure your chosen partner is likely to be there for you in the long term.

This means considering relevant enterprise-level factors such as available PdM resources, financial strength, market history, apparent market success, industrial or PdM pedigree, breadth of sensor portfolio, value proposition, and offered business models.

Much of this information can be obtained from public sources or vendor interviews, but it takes time to accumulate, even assuming you are working with a short list of vendors to start with.

Please don’t get me wrong. I’m not trying to pour cold water all over the clear trend to deploy this technology in various industries and the apparent successes publicly cited by end users of leading vendors. Nor am I simply warning caveat emptor, though this well-known Latin phrase certainly applies.

I suggest you take the time to do your homework, prepare the organization, and find competent resources to help educate you and your team. Given the time, energy, and money invested in selecting and deploying any solution, the effort is warranted.

Selecting the right wireless condition monitoring partner isn’t just about technology—it’s about long-term success and support.

In my experience, clients tasked with improving their PdM program already believe that some amount of judiciously applied continuous vibration data collection would benefit the program but want to make a good decision about their selection given the many uncertainties of their unique situation.

When speaking at a conference or canvassing the exhibit floor, I’m often asked, “Ed, which of these wireless systems is the best?” My answer is the same whether you are a potential user or one of the vendors.

An analogy I’ve offered is to envision the algorithm the average dad might work through when your college graduate daughter approaches you with her signing bonus and asks, “Dad, what is the best car to buy?”

My immediate response is, ‘It depends’. Which of the many attributes should be the priority for our search – Safety? Reliability? Quality? Economy? I will need to educate her on these concepts as they apply to automotive technology, as much as her patience and attention span will allow, and then she will have to decide.

My role in this situation is to be her coach, to give her the best advice I can while resisting the temptation to make the decision for her – even if her focus is on style and color.

Choosing a wireless condition monitoring system is like buying a car—your priorities determine the best fit.

Figure 3. Choosing a wireless condition monitoring system is like helping a college graduate buy their first car. Which features should be the focus of the search?

If your background, skills, and experience similarly equip you to work through a technology selection strategy, then you’re probably an Early Adopter and have been kicking the tires already!

But if not, consider getting advice from someone other than the car salesperson.