Rare earth elements (REEs) are the invisible enablers of modern industry. These obscure-sounding materials—names like neodymium, dysprosium, and cerium—rarely make headlines, but without them, our most sophisticated machines stop working.

Variable frequency drives, electric motors, sensors, catalytic converters, even wind turbines and electric vehicles—they all rely on rare earths to function. For those of us in asset management, MRO, and reliability engineering, this isn’t some abstract geopolitical curiosity. It’s a pressing, real-world vulnerability with potentially massive operational consequences.

Modern reliability depends on materials you’ve probably never tracked.

This article aims to make one thing clear: the risk posed by rare earth supply chain fragility isn’t a future problem—it’s a present one. If you’re responsible for uptime, throughput, or life cycle costs, you need to understand where and how REEs enter your asset base—and what to do if they’re suddenly no longer available.

The Hidden Inputs that Hold Our World Together

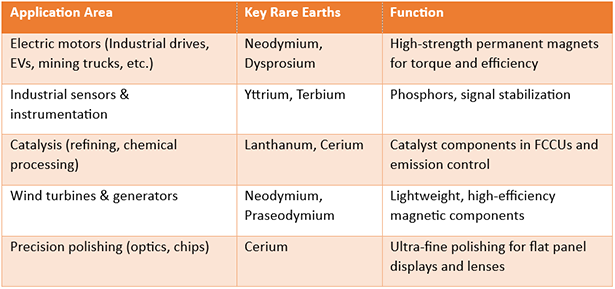

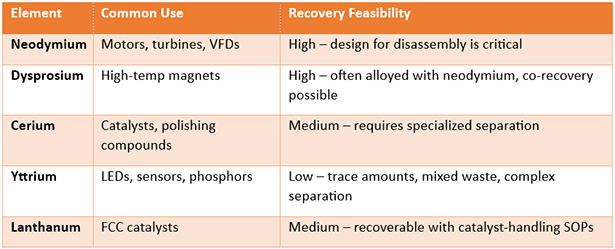

Neodymium magnets are used in everything from drives to motor windings. Cerium plays a vital role in catalytic converters and polishing compounds. Lanthanum is used in FCC catalysts. These are not boutique materials—they are foundational to the systems we rely on daily (Table 1).

In high-reliability environments like chemical processing, mining, and manufacturing, equipment performance is increasingly tied to the performance of sensors, electric actuators, drives, and clean-energy components—all of which lean heavily on rare earths. As the world doubles down on electrification and digitalization, demand for REEs will only increase.

Table 1 – Some critical applications for Rare Earths Elements (REEs).

Quantifying the Risk

Let’s put a number on it. Imagine 15% of your REE-dependent critical assets—VFD-driven pumps, high-efficiency electric motors with rare earth permanent magnets, positioners with embedded sensors, and condition monitoring devices—suddenly become unavailable due to component shortages.

Now layer in the long lead times for replacements, which may extend from weeks to months if global REE refining or export capacity is constrained. MRO Supply Chains, are you paying attention?

For a large mining or manufacturing operation, even a modest disruption in these components could halt multiple production circuits. Suppose just three motor-driven pumps on critical circuits go down due to failed VFDs or actuator motors.

The resulting downtime could easily exceed $200,000 per day in lost throughput. Add in expediting fees, technician overtime, emergency vendor mobilization, and secondary damage from unplanned shutdowns—and you’re quickly looking at seven-figure disruptions.

A rare earth bottleneck isn’t hypothetical—it’s a seven-figure disruption waiting to happen.

At the industry level, the stakes are even higher. According to the International Energy Agency, demand for rare earths used in permanent magnets could increase by a factor of seven by 2040 under its Sustainable Development Scenario.[¹]

A 20% global supply gap—even temporarily—could result in cascading supply chain effects, not unlike those witnessed during the COVID-era chip shortage. And whereas semiconductors can sometimes be worked around with legacy systems, there are no functional substitutes for neodymium-based magnets in modern high-performance motors.

The bottom line? A full-scale REE bottleneck could cost asset-intensive industries—mining, chemicals, energy, manufacturing—tens of billions in lost production annually. That’s not alarmist. It’s conservative. And it’s a scenario that can be mitigated—but only with proactive planning.

A Real-World Warning

This isn’t a theoretical exercise—it has happened before. In 2010, China abruptly reduced its rare earth element (REE) export quotas by 40%, citing environmental concerns. The impact was immediate and severe. Prices for neodymium and dysprosium—critical for high-efficiency electric motors and VFDs—skyrocketed several hundred percent.

Major industrial manufacturers, including Toyota, Hitachi, and Panasonic, were forced into emergency redesign efforts to reduce REE dependency. Supply chains were destabilized, leading to production delays, requalification efforts, and sharp increases in procurement costs.

The World Trade Organization eventually ruled in 2014 that China’s export restrictions violated trade rules, but by then, the damage was done. The episode reshaped global procurement strategies, drove new investment in alternative sources, and made clear that rare earth bottlenecks can paralyze even the most sophisticated industrial operations.

In 2024, the risk is rising again. While no full-scale embargo is in place, tightening export controls and growing geopolitical friction have already triggered delays and contract renegotiations. Many firms are now modeling REE disruption scenarios as part of standard risk management—because they know from experience just how real the threat is.

Why This is a Geopolitical Time Bomb

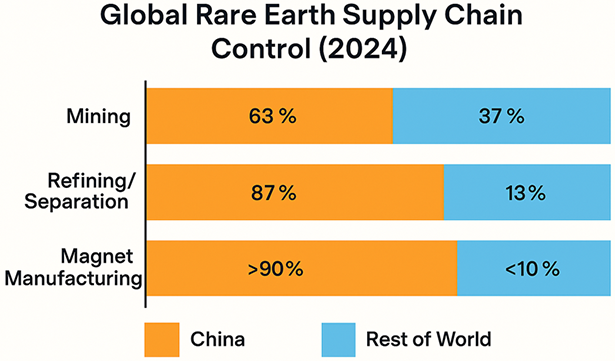

China controls over 85% of rare earth refining and more than 90% of the world’s permanent magnet manufacturing capacity (Figure 1). This dominance has been strategically developed and is now backed by national policy.

In 2010, China restricted REE exports to Japan during a diplomatic dispute, triggering global panic and an immediate spike in rare earth prices. The lesson? These are not stable, commoditized markets—they’re vulnerable chokepoints in our industrial backbone.

Figure 1 – China’s stranglehold on REE supply – especially processed minerals and magnets.

Why Major Miners Won’t Touch REEs

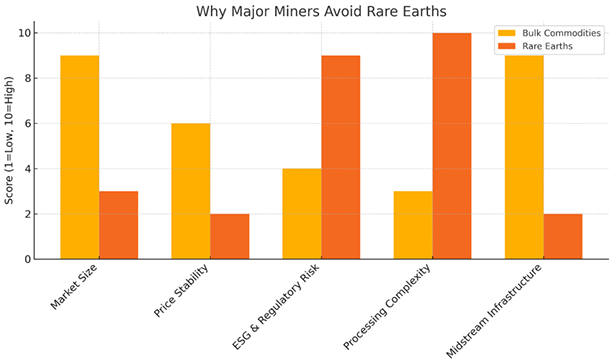

You may ask: if these materials are so important, why don’t the big miners get involved? The answer is rooted in complexity, risk, and reputation.

Rare earth ores are geologically messy. They’re often found in mineral matrices alongside thorium—a naturally occurring radioactive element—which triggers regulatory oversight, local concern, and costly environmental safeguards.

Separating individual rare earth elements (REEs) from one another is no easier: it involves solvent extraction using large volumes of water, aggressive chemicals, and extensive tailings management. This isn’t your standard dig-and-ship operation—it’s metallurgical surgery with a social license minefield.

Big miners aren’t avoiding rare earths by accident—they’re dodging a regulatory minefield.

On top of that, the midstream infrastructure required to turn REE oxides into alloys, magnets, or precision components is poorly developed outside of China. In many cases, mining majors would need to vertically integrate—or form joint ventures just to process what they produce—piling risk on top of risk.

Then there’s the pricing problem. REE markets are historically volatile, distorted by Chinese state subsidies, strategic stockpiling, and export controls. For publicly traded mining giants under scrutiny for ESG performance and shareholder value, it’s hard to justify entering a high-risk sector where returns may be opaque and highly politicized (Figure 2).

Figure 2 – The REE market presents significant risks to major, mainstream mining companies, which explains their hesitance to enter the market.

It’s no wonder most major mining companies have taken a pass. Instead, REEs have been left to junior miners, niche players, and a handful of government-backed initiatives.

And that’s the problem. If the private sector alone won’t shoulder the risk, then a public–private model must emerge. Strategic cooperation—blending mining expertise, government incentives, and industrial policy—may be the only viable path to stabilizing the rare earth supply chain. Nations that treat REEs as a matter of national infrastructure will lead in both economic resilience and energy transition.

The MRO Black Hole

Maintenance, Repair, and Operations (MRO) supply chains were never built with rare earth visibility in mind. Traditional ERP and CMMS systems are excellent at tracking part numbers and maintenance intervals—but they’re blind to the elemental composition of the components they catalog. There’s no standardized field for “contains REEs,” no flag for neodymium-dependent motors or samarium-cobalt sensors. The digital backbone of industrial asset management simply doesn’t recognize rare earths as a risk variable.

Your CMMS knows the part number—but not that it depends on rare earths.

The situation is further complicated by vendor opacity. Many suppliers genuinely don’t know if the subcomponents inside their assemblies contain rare earths. Others may know—but choose not to disclose, fearing lost business or triggering costly requalifications. As a result, reliability engineers and asset managers are flying blind. You may assume a critical VFD or position sensor is just another stocked item—until a shipment is delayed indefinitely due to upstream restrictions on magnet imports or actuator sourcing.

The implications are serious. If your operation runs 24/7 with limited spares, you’re one failed component away from cascading downtime. And the frustrating truth is: you may not even know which assets are REE-dependent until it’s too late.

That’s why it’s time to elevate REE-dependent components to the same level of scrutiny as proprietary castings, long-lead-time gearboxes, or safety-critical valves. These parts deserve:

- Unique MRO codes tied to elemental content or vulnerability,

- Lead-time flags that reflect global REE supply chain volatility,

- Dual or tertiary sourcing strategies that include recycled or low-REE alternatives,

- Data integration protocols that map REE dependencies from BOM to maintenance plans.

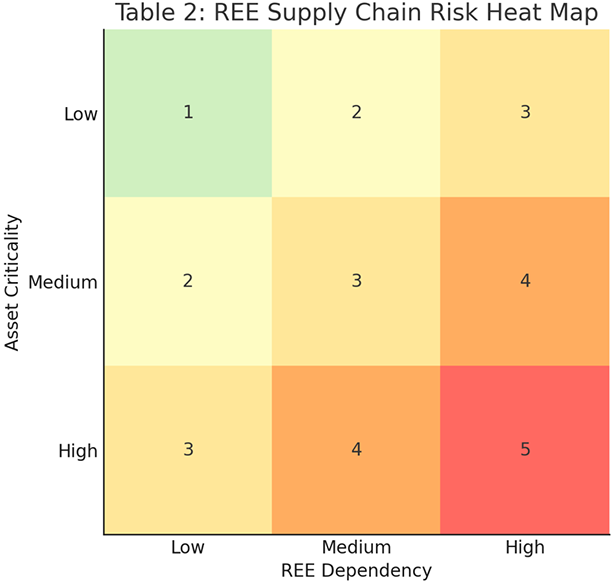

This is not just a procurement issue—it’s a core element of modern asset management. Until REEs are surfaced in your MRO systems, you’re managing a hidden risk with potentially catastrophic consequences (Figure 3).

Figure 3 – Understand your critical assets’ reliance on REEs.

What Happens If We Do Nothing?

Failure to act will have real consequences:

- Costs will rise as OEMs scramble to source replacements

- Emergency work orders will replace planned PMs

- Component quality will degrade as inferior substitutes enter the market

- Uptime will fall, KPIs will suffer, and regulators may step in

- Market share could shift toward companies with more resilient supply chains

This is not alarmism. It’s risk literacy. And it’s time to raise the level of conversation.

A Five-Phase Response Framework

Phase 1: Assess Your Exposure – Audit your motor drives, catalyst systems, sensors, and actuators. Engage OEMs to declare REE content. Build a baseline of REE dependency across your asset fleet.

Phase 2: Diversify Your Supply – Avoid sole-sourced REE-dependent components. Push procurement to identify alternative suppliers or geographies. Ask vendors: where are these materials refined? What is your backup plan?

Phase 3: Build REE Visibility into Systems – Modify your CMMS or ERP to tag REE-reliant SKUs. Link this data to your criticality assessments. Know which REE risks sit in your top quartile of asset impact.

Phase 4: Support Smart Policy – Encourage government action to invest in domestic refining and allied magnet plants. Public-private partnerships may be the only path to secure, scalable alternatives.

Phase 5: Enable Circularity – Design job plans and teardown instructions to recover REEs. Set up contracts with recyclers to take back motors, magnets, and catalysts. Close the loop wherever you can.

Can We Recycle Our Way Out?

It’s a tempting idea: if mining is risky, expensive, and geopolitically fraught, why not just recycle rare earth elements (REEs) from the assets we already have? In theory, it’s a circular economy dream—closed-loop sourcing for the metals that underpin our most advanced equipment. But the practical reality is far more complicated.

The recyclability of rare earths is highly element-dependent. Neodymium and dysprosium—used in the powerful magnets embedded in electric motors, wind turbines, and variable frequency drives—are technically recoverable. But they rarely travel alone.

These magnets are tightly integrated into housings, rotors, and sealed electronic assemblies. Extracting them intact requires labor-intensive disassembly, thermal or chemical treatment, and often yields small quantities unless scaled properly.

Recycling rare earths sounds easy—until you try to get the magnets out.

On the other hand, cerium and lanthanum—widely used in fluid catalytic cracking (FCC) catalysts and polishing powders—pose a different challenge. Their recovery depends on how the materials are deployed and how effectively spent catalyst and polishing waste can be captured, sorted, and reprocessed. In many plants, these materials end up in mixed industrial waste streams with low recovery potential.

Yttrium—used in phosphors, sensors, and LEDs—is even more elusive. It tends to appear in trace quantities, dispersed across complex assemblies and end-of-life electronics. Recovering it at industrial scale remains technically possible, but economically unattractive without incentives or stringent regulatory mandates. Table 2 summarizes the recyclability of various REEs.

Table 2 – The practical recyclability of various rare earths assuming current technology.

Today, less than 1% of the global REE supply comes from recycled sources—a stunning figure given their criticality. That must change.

But closing the loop isn’t just a matter of developing better recycling technologies. It requires upstream action:

- Engineering disassembly into motor and equipment design,

- Teardown protocols that recover magnets, phosphors, and catalyst substrates before they become waste,

- Supply contracts that include buy-back or recycling incentives, and

- Policy support—including subsidies, tax credits, or mandates—to help scale rare earth recycling infrastructure.

In asset-intensive industries, we already think in terms of refurbishment and rebuild cycles. Extending that mindset to include elemental recovery from failed or retired equipment is the next logical step. It’s not just sustainable—it may be the only way to stabilize long-term supply.

What You Should Be Asking Vendors

- Which rare earths are used in this product?

- Where are they mined and processed?

- Do you have substitution options?

- What’s your plan for component EOL recovery?

Push these questions early—before a disruption pushes you.

What Tools Can Help?

Advanced CMMS platforms with BOM traceability, supply chain visibility tools, and AI-based risk analysis dashboards can help asset managers map REE exposure. It’s time to treat this like we treat safety and environmental compliance—with rigor, not gut instinct.

Cross-functional collaboration is key. Engineers, MRO teams, procurement, and sustainability leads must align. The goal: reliable assets, no matter what the world throws at your supply chain.

Lead the Shift, Don’t Trail the Risk

Companies that treat rare earth dependency as a strategic risk—not just a sourcing headache—will emerge as the winners. The ones who wait for the first major disruption will be too late. This is our moment to lead—not react.

Let’s hardwire resilience into the assets that power the world.

Strategies:

- Use serialized tracking for large components with REE value

- Require vendors to offer end-of-life recovery services

- Work with recyclers equipped for magnet and catalyst recovery

- Embed REE disassembly procedures in standard job plans

Further Reading

- USGS Mineral Commodity Summaries: Rare Earths (2024)

- EU Critical Raw Materials Act Summary

- DOE Critical Materials Innovation Hub

References

- International Energy Agency (IEA). (2021). The Role of Critical Minerals in Clean Energy Transitions. Retrieved from https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

- S. Geological Survey (USGS). (2023). Mineral Commodity Summaries: Rare Earths. Retrieved from https://pubs.usgs.gov/periodicals/mcs2023/mcs2023-rare-earths.pdf

- S. Department of Energy (DOE), Office of Policy. (2023). Critical Materials Strategy. Retrieved from https://www.energy.gov/policy/critical-materials

- Brookings Institution. (2019). Rare Earth Elements: The Global Supply Chain. Retrieved from https://www.brookings.edu/research/rare-earth-elements-the-global-supply-chain/

- Organisation for Economic Co-operation and Development (OECD). (2022). Environmental Risks and Challenges of Rare Earth Element Supply Chains. Retrieved from https://www.oecd.org/environment/waste/policy-highlights-environmental-impacts-rare-earth-elements.pdf

- (2023). Tracking the Trends 2023: The Top 10 Issues Transforming the Future of Mining. Retrieved from https://www2.deloitte.com/global/en/pages/energy-and-resources/articles/tracking-the-trends.html

- World Bank. (2020). Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition.

- Lawrence Livermore National Laboratory (LLNL). (2023). New Technologies Offer Hope for Rare Earth Recycling. Retrieved from https://www.llnl.gov/news/new-technologies-offer-hope-rare-earths-recycling

- McKinsey & Company. (2022). Securing Critical Raw Materials for the Energy Transition. Retrieved from https://www.mckinsey.com/business-functions/operations/our-insights/securing-critical-raw-materials

- Rare Earth Industry Association (REIA). (2024). Global Rare Earths Industry Reports and Resources. Retrieved from https://www.global-reia.org/