Imagine a $10 billion mining company—not underperforming, not best-in-class, just… average. The plants run, but not without drama. The maintenance budget creeps up every year. Emergency jobs are down this month—barely. There’s some vibration in the mill that no one’s gotten around to investigating. The site planner is heroic, but exhausted. And every year, the sustaining capital ask grows.

Now imagine that same company—let’s call it XYZ Mining—adopts the asset management practices of upper-quartile performers in the petrochemical industry. Operators that treat reliability like a system, not a slogan. What’s that worth? Let’s run the numbers.

XYZ Mining earns about $10 billion in annual revenue with an EBITDA margin of 30%, generating roughly $3 billion per year. About 35–45% of total operating cost is asset-related—maintenance, sustaining capital, and reliability losses—adding up to around $2.5 to $3 billion in spend.

The $750 Million Breakdown

Top-tier petrochemical companies operate 15–25% more efficiently on a lifecycle basis. That’s not by cutting corners—it’s by planning better, executing precisely, and running equipment that simply breaks less.

If XYZ Mining could capture that performance delta, the conservative estimate is a $650M to $980M annual bottom-line uplift.

Where does it come from?

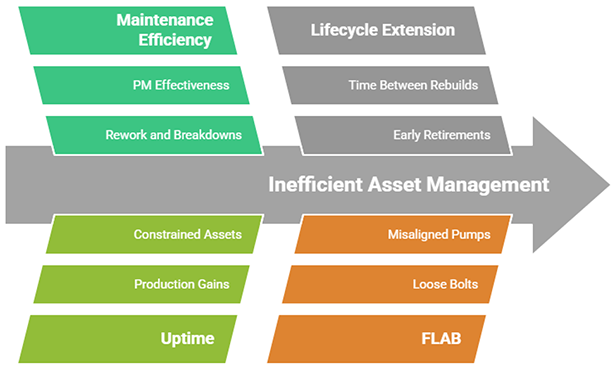

- Maintenance efficiency: less rework, fewer breakdowns, better PM effectiveness

- Uptime: just a 1–2% improvement at constrained assets equals real production gains

- Lifecycle extension: more time between rebuilds, fewer early retirements

- Energy and fluid efficiency: better FLAB (Fastening, Lubrication, Alignment, Balance) reduces parasitic losses

- Inventory optimization: less capital tied up in slow-moving or obsolete spares

Figure 1 – Loss drivers when asset management doesn’t work right.

FLAB Foundation

FLAB may sound basic—but it’s foundational. Loose bolts, over-greased bearings, unbalanced fans, misaligned pumps—these are the quiet killers of uptime and cost control. Our model attributes 43% of the total value uplift—about $325 million per year—to getting FLAB right.

FLAB isn’t flashy, but it’s a $325 million foundation.

From EBITDA to Enterprise Value

Now let’s talk valuation. A $750M uplift in EBITDA, we’ll assume produces a net profit of $350M after interest, tax, depreciation, and amortization. If we assume a Price to Earnings ratio (P/E) of 15 to 20, that translates into $5.25B to $7.0B in enterprise value. For a company with 800 million shares outstanding, that’s a $6 to $8.75 increase in share price—or a 12–25% lift—all else held equal.

One could argue that the more profitable variation of this firm could drive a higher P/E, especially if this is accompanied by lower volatility. Volatility is reported as Beta (β). Very simply, a β=1.0 reflects the larger market.

A lower β indicates lower volatility and a high β indicates higher volatility. Assuming a P/E of 15 with β=1.0, a β=0.7 would be rewarded with a P/E of ~ 20.0 and a β=1.3 would be punished with a P/E of ~12.0.

The stock market tends to reward lower volatility proportionately more than it punishes higher volatility. So, everything else held equal, the more reliable operation should produce less volatile results, which increases the odds of achieving the upper end of the value creation spectrum.

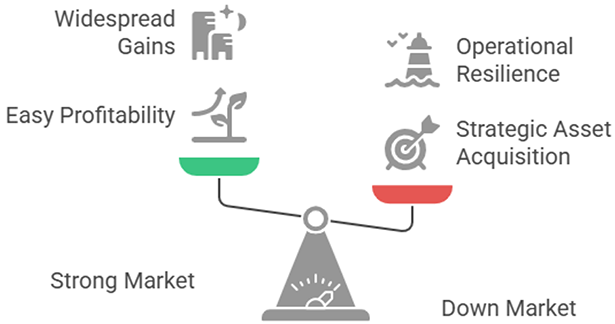

Defense in a Downturn

And here’s the part most people miss: in a strong market, everyone makes money. But in a down market—when prices fall and margins compress—the best operators are the last to bleed red ink. Their assets break less, cost less, and run longer. Reliability becomes a margin defense strategy.

Reliability becomes a margin defense strategy.

Buy Low, Run Lean

Even more strategically, top operators have cash when others don’t. Poor performers start selling assets at the bottom of the cycle. That’s when companies like XYZ Mining can step in, buy distressed operations at a discount, and apply proven asset management practices to unlock value the sellers couldn’t reach.

Lower Volatility

And one more benefit: less volatility. Better-managed assets create more stable cash flow, which means steadier earnings, less market anxiety, and tighter trading multiples. Reliability doesn’t just show up in the plant. It shows up in the stock price.

Figure 2 – Asset management drives value in strong markets and down markets.

Final Words

Asset management isn’t just about maintenance cost. It’s about cash generation, capital efficiency, strategic advantage, and investor confidence. And in a world where capital is tight and cycles are real, upper-quartile asset management isn’t just smart—it’s survival.