In today’s fast-paced, asset-intensive industries, reliability professionals and asset managers face increased pressure. They must ensure critical equipment operates optimally, avoids costly downtime, and maintains a long lifecycle.

However, the road to getting there can be bumpy and uncertain. Every asset or piece of complex equipment—from pumps and vehicles to electrical transformers and water treatment plants—faces risks. These risks can lead to failure due to unforeseen operational stresses or external factors.

Professionals enhance asset reliability and overall organizational performance by adopting a strategic, risk-based approach.

Effective risk management that addresses strategic, operational, and tactical risks becomes indispensable. Adopting a strategic, risk-based approach enables informed decision-making. This enhances asset reliability and improves organizational performance.

Understanding Risk Within Asset Management

In asset management, risk is the likelihood of an event and its negative consequences. These consequences can affect an asset’s safety, reliability, or performance. Events range from internal issues—like mechanical failures and system breakdowns—to external threats, such as severe supply chain interruptions.

They may also include significant regulatory changes. Organizations must identify, evaluate, and mitigate these risks. They must also ensure that assets deliver value throughout their lifecycle.

Risk is defined as an event’s likelihood and potential negative consequences, which challenge asset safety, reliability, and performance.

For reliability professionals and asset managers, risk management goes beyond minimizing the likelihood of an asset failure. As noted in the GFMAM Asset Management Landscape, ‘asset management is the coordinated effort of the organization to deliver value from assets.’

The objective is to deliver value throughout the asset lifecycle, balancing costs, risk, and performance. In reality, this means that there is a focus on balancing risk and reward – effectively optimizing performance while managing and minimizing the potential for losses.

Reliability professionals integrate risk assessments, mitigation strategies, and ongoing monitoring. This proactive maintenance approach improves asset performance.

Risk Management Guidelines and Frameworks

Successful risk management within the asset management context starts with a clear framework that defines how risks are identified, evaluated, mitigated, monitored, and communicated. As risk management is integral to decision-making, reliability professionals are called upon to consider risk in every activity.

The most widely adopted approach to risk management is based on ISO 31000. Most organizations align to this international standard, whether explicitly or directionally. This provides some consistency in how risk is approached within the organization and attempts to minimize personal bias.

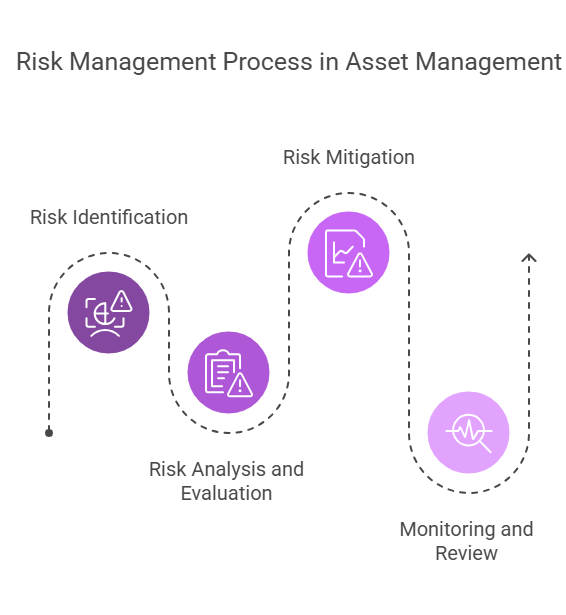

The following are typical risk management process steps. Reliability professionals have a role to play in all of them.

Step 1: Risk Identification

This starts with identifying the sources of risk, potential events or consequences, and the most likely impact areas. Reliability professionals and asset managers consider mechanical or structural failures and environmental factors. They also assess operating context and economic factors like demand or market functions. Each industry sector will have its common sources of risk.

Techniques such as FMECA and RCFA are used to identify potential risks. In addition, reliability-centered maintenance (RCM) is commonly employed. Asset criticality analysis (ACA) can ensure that any risk management is focused on the most critical assets to the organization.

Cross-functional team participation ensures a comprehensive capture of risks—spanning safety, operational, environmental, and financial dimensions.

It’s not simply a function of how expensive the physical asset is to buy or replace. Participation of cross-functional teams helps to capture the broadest range of potential risks – from safety to environmental to operational to financial.

Step 2: Risk Analysis and Evaluation

After the risks have been identified, the next step is to determine the impact and the likelihood of these potential events occurring. Quantifying the risks involves analyzing the frequency of failure events and their consequences on asset performance. It is common to categorize consequences using the SHEER framework.

This stands for safety and health, environment, economics (production), and regulatory compliance. See my previous article discussing SHEER. Tools like risk matrices or probabilistic models can help to prioritize the most significant risks. The risks can then be compared to established criteria and a decision to treat or accept the risks.

The goal is to focus resources on mitigating the most significant risks. These include safety incidents, environmental impacts, and unscheduled downtime. In practice, many organizations group the first two steps and refer to them as performing a risk assessment.

Step 3: Risk Mitigation

The goal of risk mitigation is to develop and implement strategies to reduce or eliminate the likelihood of the event occurring or reduce the consequences if it does happen. The risks identified in the first two steps are compared against the established criteria for the organization, and a decision is made on whether to treat the risks or accept them.

Common mitigation techniques include preventive maintenance (PM), predictive maintenance (PdM), and failure-finding tasks (FFT). Reliability professionals may also recommend redesigning or adding redundancies to critical systems. These approaches may eliminate the risks entirely.

Alternatively, they provide advanced warning through PdM, allowing for planned maintenance. Sometimes, the best course of action is to accept the risk given the estimated operational and financial impact. Regardless, it is important to engage with the relevant stakeholders so that they are aware and aligned with the recommendations for risk mitigation.

Step 4: Monitoring and Review

The final step recognizes that risk management is an ongoing process. Risk identification and evaluation are influenced by the asset lifecycle, external and internal factors, and changes in operating context. They are also affected by emerging risks and the effectiveness of implemented mitigation strategies.

This is why continuous monitoring of assets, real-time data analytics, and periodic condition monitoring are relied on for asset health monitoring. Based on this data, reliability professionals can make informed recommendations. They act to minimize risks when early indicators of asset failure or changes in context appear.

Continuous monitoring and real-time analytics empower proactive detection of early indicators of asset failure.

Regular audits and reviews of risk management practices can support the implementation of risk strategies that remain relevant and effective. Communicating with stakeholders about the success of the implemented risk management approach and opportunities for continuous improvement closes the loop of a Plan-DO-Check-Act cycle. It’s not a checkbox exercise; it adds genuine business value.

Collaboration and Communication Across Teams

Effective risk management requires seamless communication and collaboration across all teams. This includes reliability, maintenance, asset management, operations, engineering, supply chain, and finance.

Reliability professionals are often tasked with facilitating and managing risk management practices related to physical asset operating performance.

They must ensure that the cross-functional team understands the risks and the strategies to manage them. This requires developing a shared understanding of the asset’s performance criteria, operating context, risk tolerance, and business objectives.

Regular cross-functional meetings and updates serve to align all stakeholders on existing and emerging risk priorities and make decisions based on comprehensive data. Through a culture of collaboration, organizations can improve their decision-making, streamline asset management processes and coordination, and enhance meeting overall organizational objectives.

In the evolving landscape of asset management, risk management is no longer a mere afterthought to be addressed on a reactive basis. It is a strategic process that directly influences an organization’s safety, reliability, and profitability. Reliability professionals and asset managers must adopt a structured, data-driven approach to risk.

Including input from all stakeholders is essential for optimizing asset performance, minimizing downtime, and extending asset life. A continuous approach to risk—identifying, analyzing, evaluating, mitigating, and monitoring—protects physical assets. It also enables organizations to achieve sustainable growth in an uncertain world.

Learn more about root cause analysis in the book I co-authored with Ricky Smith: Root Cause Analysis Made Simple.